The Market today

Innovation is not an option but a reality

Insurance Products are evolving towards a Service concept and Customer loyalty towards an Experience-based model. This change in the market provides the opportunity to design new models for Revenue generation based on the Experience economy. A Digital operating model and the implementation of the Omni distribution and Omni channel strategic concepts are the enabling tools to implement new successful Revenue generation models.

Millennials and their new habits and preferences, the sharing-economy, the population aging, an increased urbanization, a growing middle-class, the Internet access, the massification of mobile devices, the connectivity and Internet of things and the new technologies, bring about disruptive changes in all markets.

The Insurance Industry is immersed in all this and its traditional way of doing business is now being questioned. Its future will be driven by a significant digital revolution, mainly triggered by technological changes and the way in which consumers buy and use products and services.

What innovation models are needed?

Being Digital … what business challenges does it solve and what new opportunities does it offer?

How should an Insurance Company be organized to be digitally successful?

| Factors that impact the Industry: |

| - | Economy |

| - | Technology |

| - | Regulations |

| - | Customer Expectations |

| The Strategic Way: |

| - | Focus on the Customer |

| - | Master Regulations |

| - | Cibersecurity Agenda |

| - | Use of availables Technologies |

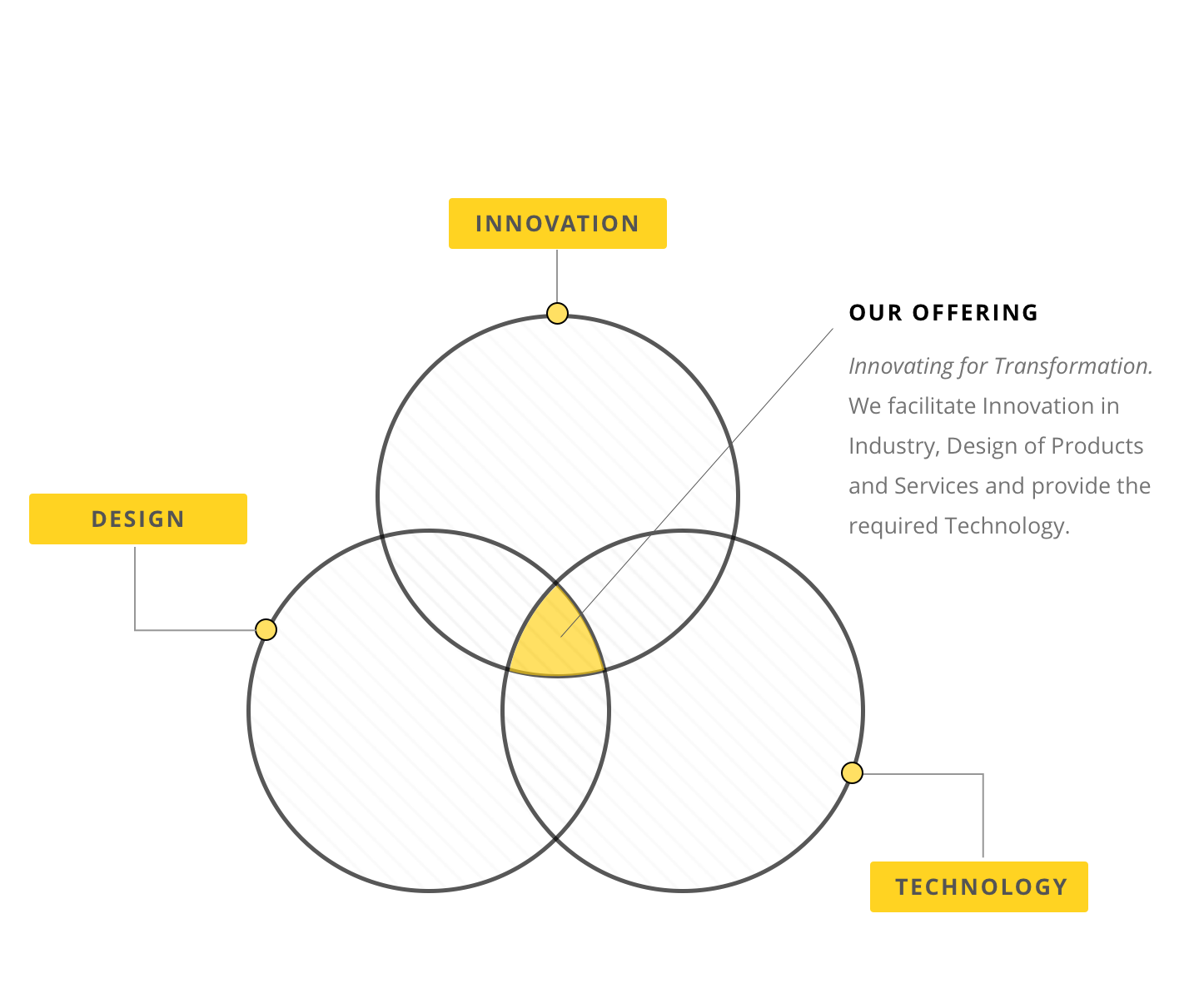

Our

Success Formula

The Industry context, at a local, regional and global level, is increasingly complex and uncertain. New players and new technologies are proposing disruptive changes in the way Insurance is purchased and distributed. The demands and requirements of final Customers - individuals and companies, drive the need for a change.

Our Solutions will enable all players in the Insurance Industry – Insurers, Brokers, Producers, Agents, Sales Channels, Bancassurance and final Customers, to have the best tools and technologies available to be leaders in their segments, stay one step ahead and develop their business in a simple, transparent and controllable manner.

Our Innovation Solutions for Transformation

Which theories and practices are being implemented at a global level?

How are new trends integrated into local reality?

How to use them to make the most of creative capacity?

Innovation Experience

Our Innovation strategy combines the abilities and skills required to innovate, using a Methodology designed to turn challenges into opportunities. We identify and prioritize innovative Projects that help our Customers face the challenges posed by the market, the technological revolution and consumer needs.

Digital First

Being Digital. This is the definition and the key and core concept of our approach to Innovation. We prioritize digital and on-line over traditional media for the development of Distribution channels, interaction and communication with Customers and management of all processes involving Marketing and Sales, Issuance, Payment and Collection, Documentation, Claims and Losses. We implement a fully Digital operating model.

Omni Distribution

The concept of Omni Distribution is introduced as a consequential goal of Being Digital, based on the Distribution process uniformity and transparency, regardless of the channel through which Customers purchase insurance or manage their insurance requirements. We set up new digital trends including solutions to create MARKETS, PURCHASE insurance in a simple and secure way, COLLECT at the point-of-sale and provide on-line Information.

Situation Room

Analytical Solutions and Models, based on Big Data and Business Intelligence platforms, will allow you to have Management information in the device you are using at any time to connect to the Internet. Having key business indicators available will improve your decision-making process, the design and development of the best distribution strategies and the possibility to make changes when required.

Payment Methods

The shift towards digital interaction with Customers creates opportunities for disintermediation, cost savings and monetization and cash flow models. We provide digital Payment Method solutions for mobile devices and Web platforms and Collection management solutions through different media such as on-line transfers, debit and credit cards.

Our Methodology

Inspire

Our Innovation Experience-based inspirational approach and its laboratory of ideas are the first step in the creation of an innovation path towards transformation. We share experiences that encourage out-of-the-box thinking.

Create

The best way to learn about and understand the potential impact of an idea or change is through action. We prioritize ideas and turn them into Prototypes to assess their potential, business impact and needs for change. Successful creation requires knowledge, practice and teamwork.

Build

Our Methodology helps materialize your thoughts, ideas and wishes. We go from the concept to the building of a Product and/or Service using a validated methodology such as Lean Startup.

Implement

At this stage teams are built to implement new added-value Products and Services that will allow companies to attain business goals. A collaborative environment and our functional and technical knowledge are central to success.

Grow

Going across the previous Stages safely and successfully will allow companies to make the most of their creative and transformation capacity. We support companies in all post implementation phases to ensure achievement of goals. Weekly follow-up meetings are scheduled to empower each Innovation and Transformation initiative.